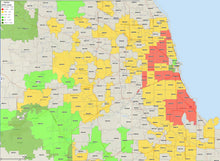

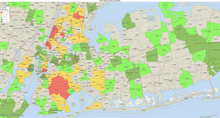

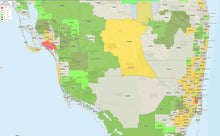

IRS Tax Year 2019 and 2021 Data - By Zip Code

Regular price

$2,900.00

Sale

IRS Tax Year 2019 and 2021 Data - By Zip Code

Format: Microsoft Excel

Dataset content

- IRS tax data for the years 2019 and 2021

- 150+ data points for each Zip code

- Amounts in thousands of dollars

- Three files, prepared for upload to the RealZips app

- Data source: IRS Gov / Statistics

Use cases

- Demographic targeting across Zip codes

- Drill-down: from Census Region, down to Zip code.

- Analytics related to: change in population, Income, family size, average dividends, home ownership, mortgage interest paid, education expenses, IRA payments, charitable contributions, retirement status, social security benefits, child tax credit, etc.

The comparison between taxpayers per zip code is based on the years 2019 and 2021, showcasing the shift in population before and after the COVID outbreak.

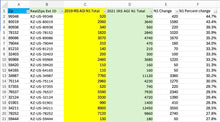

RealDatasets - IRS 2019 and 2021 - AGI Stubs Count - by RealZip.xls

Included data points for comparison:

- RealZips Ext ID

- IRS AGI 1: Up to 25k

- IRS AGI 2: 25K to 50K

- IRS AGI 3: 50K to 75K

- IRS AGI 4: 75K to 100K

- IRS AGI 5: 100K to 200K

- IRS AGI 6: 200K and up

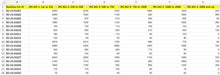

RealDatasets - IRS 2019 and 2021 - AGI Stats (No AGI) - ZIP code

Included data points:

- N1 - Number of returns

- MARS1 - Number of single returns

- MARS2 - Number of joint returns

- MARS4 - Number of head of household returns

- ELF - Number of electronically filed returns

- CPREP - Number of computer prepared paper returns

- PREP - Number of returns with paid preparers signature

- DIR_DEP - Number of returns with direct deposit

- VRTCRIND -Number of returns with virtual currency indicator

- N2 - Number of individuals

- TOTAL_VITA - Total number of volunteer prepared returns

- VITA - Number of volunteer income tax assistance (VITA) prepared returns

- TCE - Number of tax counseling for the elderly (TCE) prepared returns

- VITA_EIC - Number of volunteer prepared returns with Earned Income Cred

- RAC - Number of refund anticipation check returns

- ELDERLY - Number of elderly returns

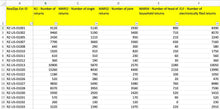

- A00100 - Adjust gross income (AGI)

- N02650 - Number of returns with total income

- A02650 - Total income amount

- N00200 - Number of returns with salaries and wages

- A00200 - Salaries and wages amount

- N00300 - Number of returns with taxable interest

- A00300 - Taxable interest amount

- N00600 - Number of returns with ordinary dividends

- A00600 - Ordinary dividends amount

- N00650 - Number of returns with qualified dividends

- A00650 - Qualified dividends amount

- N00700 - Number of returns with state and local income tax refunds

- A00700 - State and local income tax refunds amount

- N00900 - Number of returns with business or professional net income (less loss)

- A00900 - Business or professional net income (less loss) amount

- N01000 - Number of returns with net capital gain (less loss)

- A01000 - Net capital gain (less loss) amount

- N01400 - Number of returns with taxable individual retirement arrangements distributions

- A01400 - Taxable individual retirement arrangements distributions amount

- N01700 - Number of returns with taxable pensions and annuities

- A01700 - Taxable pensions and annuities amount

- SCHF - Number of farm returns

- N02300 - Number of returns with unemployment compensation

- A02300 - Unemployment compensation amount

- N02500 - Number of returns with taxable Social Security benefits

- A02500 - Taxable Social Security benefits amount

- N26270 - Number of returns with partnership/S-corp net income (less loss)

- A26270 - Partnership/S-corp net income (less loss) amount

- N02900 - Number of returns with total statutory adjustments

- A02900 - Total statutory adjustments amount

- N03220 - Number of returns with educator expenses

- A03220 - Educator expenses amount

- N03300 - Number of returns with Self-employed (Keogh) retirement plans

- A03300 - Self-employed (Keogh) retirement plans amount

- N03270 - Number of returns with Self-employed health insurance deduction

- A03270 - Self-employed health insurance deduction amount

- N03150 - Number of returns with Individual retirement arrangement payments

- A03150 - Individual retirement arrangement payments amount

- N03210 - Number of returns with student loan interest deduction

- A03210 - Student loan interest deduction amount

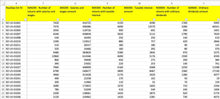

- N04450 - Number of returns with total standard deduction

- A04450 - Total standard deduction amount

- N04100 - Number of returns with basic standard deduction

- A04100 - Basic standard deduction amount

- N04200 - Number of returns with additional standard deduction

- A04200 - Additional standard deduction amount

- N04470 - Number of returns with itemized deductions

- A04470 - Total itemized deductions amount

- A00101 - Amount of AGI for itemized returns

- N17000 - Number of returns with Total medical and dental expense deduction

- A17000 - Total medical and dental expense deduction amount

- N18425 - Number of returns with State and local income taxes

- A18425 - State and local income taxes amount

- N18450 - Number of returns with State and local general sales tax

- A18450 - State and local general sales tax amount

- N18500 - Number of returns with real estate taxes

- A18500 - Real estate taxes amount

- N18800 - Number of returns with Personal property taxes

- A18800 - Personal property taxes amount

- N18460 - Number of returns with Limited state and local taxes

- A18460 - Limited state and local taxes

- N18300 - Number of returns with Total taxes paid

- A18300 - Total taxes paid amount

- N19300 - Number of returns with Home mortgage interest paid

- A19300 - Home mortgage interest paid amount

- N19500 - Number of returns with Home mortgage from personal seller

- A19500 - Home mortgage from personal seller amount

- N19530 - Number of returns with Deductible points

- A19530 - Deductible points amount

- N19570 - Number of returns with Investment interest paid

- A19570 - Investment interest paid amount

- N19700 - Number of returns with Total charitable contributions

- A19700 - Total charitable contributions amount

- N20950 - Number of returns with Other non-limited miscellaneous deductions

- A20950 - Other non-limited miscellaneous deductions amount

- N04475 - Number of returns with Qualified business income deduction

- A04475 - Qualified business income deduction

- N04800 - Number of returns with taxable income

- A04800 - Taxable income amount

- N05800 - Number of returns with income tax before credits

- A05800 - Income tax before credits amount

- N09600 - Number of returns with alternative minimum tax

- A09600 - Alternative minimum tax amount

- N05780 - Number of returns with excess advance premium tax credit repayment

- A05780 - Excess advance premium tax credit repayment amount

- N07100 - Number of returns with total tax credits

- A07100 - Total tax credits amount

- N07300 - Number of returns with foreign tax credit

- A07300 - Foreign tax credit amount

- N07180 - Number of returns with child and dependent care credit

- A07180 - Child and dependent care credit amount

- N07230 - Number of returns with nonrefundable education credit

- A07230 - Nonrefundable education credit amount

- N07240 - Number of returns with retirement savings contribution credit

- A07240 - Retirement savings contribution credit amount

- N07225 - Number of returns with child and other dependent credit

- A07225 - Child and other dependent credit amount

- N07260 - Number of returns with residential energy tax credit

- A07260 - Residential energy tax credit amount

- N09400 - Number of returns with self-employment tax

- A09400 - Self-employment tax amount

- N85770 - Number of returns with total premium tax credit

- A85770 - Total premium tax credit amount

- N85775 - Number of returns with advance premium tax credit

- A85775 - Advance premium tax credit amount

- N10600 - Number of returns with total tax payments

- A10600 - Total tax payments amount

- N59660 - Number of returns with earned income credit

- A59660 - Earned income credit amount

- N59720 - Number of returns with excess earned income credit

- A59720 - Excess earned income credit (refundable) amount

- N11070 - Number of returns with additional child tax credit

- A11070 - Additional child tax credit amount

- N10960 - Number of returns with refundable education credit

- A10960 - Refundable education credit amount

- N11560 - Number of returns with net premium tax credit

- A11560 - Net premium tax credit amount

- N06500 - Number of returns with income tax after credits

- A06500 - Income tax after credits amount

- N10300 - Number of returns with tax liability

- A10300 - Total tax liability amount

- N85530 - Number of returns with additional Medicare tax

- A85530 - Additional Medicare tax amount

- N85300 - Number of returns with net investment income tax

- A85300 - Net investment income tax amount

- N11901 - Number of returns with tax due at time of filing

- A11901 - Tax due at time of filing amount

- N11900 - Number of returns with total overpayments

- A11900 - Total overpayments amount

- N11902 - Number of returns with overpayments refunded

- A11902 - Overpayments refunded amount

- N12000 - Number of returns with credit to next year’s estimated tax

- A12000 - Credited to next year’s estimated tax amount